Objectives

This tutorial is meant to introduce pomodoro package only, using a case study. The purpose of this package is modelling and reporting the predictive modelling with ease.

Dataset

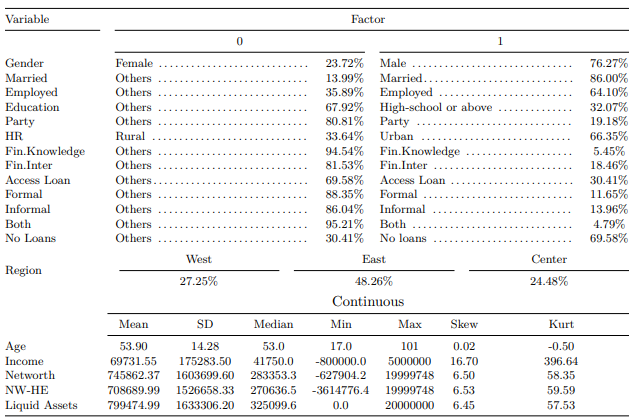

After cleaning the data set for this case study, we can visualize the summary statistics of the given data.

Note: HR stands for Household Registration. NW-HE is net-worth minus home equity. All the asset variables (e.g. income, net-worth, NW-HE, and liquid assets are in Chinese renminbi (CNY).

Overview

Package pomodoro runs currently bagging

(BAG_Model), boosting (GBM_Model), random

forest (RF_Model), multinominal logistic

(MLM_Model), and logistic models (GLM_Model).

This package is useful when you need the compare the predictive modeling

using the different data splits or/and adding exogenous variables into

the equation. And it divides the data set into 80/20 train/test set,

using stratified random sampling and implements 10 cross validation to

each model.

Installation

You can install pomodoro from CRAN with:

Building a Selected Model

Let’s build RF_Model one of the models which is

available for this package. In the pomodoro help

field we can see that RF_Model was defined as

RF_Model(Data, xvar, yvar).

DataSet

For the computational purposes lets take the first 1000 rows of the

sample_data.

Selecting Dependent Variables

where xvar is a vector which is defined as below:

Selecting Independent Variables

where yvar is a two or multilevel factor variable which

is defined as below:

or

Implemantation

We can implement RF_Model for

yvar <- c("multi.level") as follows,

Results of the RF_Model

Using attributes(BchMk.RF), we can see the outcome

options.

BchMk.RF$results

mtry Accuracy Kappa AccuracySD KappaSD

1 2 0.7640207 0.1712487 0.01929120 0.06294866

2 6 0.7288629 0.1729132 0.06145650 0.15118984

3 11 0.7264250 0.1782029 0.03964603 0.11603731head(BchMk.RF$Pred_prob)

BchMk.RF$Roc

Call:

multiclass.roc.default(response = Y.test, predictor = Pred.prob)

Data: multivariate predictor Pred.prob with 2 levels of Y.test: zero, one.

Multi-class area under the curve: 0.7143BchMk.RF$ConfMat

BchMk.RF$ACC

Building an Estimated Models

To model all the data set and its splits, interchangeably with 3

assets owning variables

(networth, networth_homequity, and liquid.assets) and given

an exogenous variable, in this case

exog = "political.afl".

Let’s build RF_Model again but this time . In the

pomodoro help

field we can see that Estimate_Models was defined as

Estimate_Models(DataSet = Data, yvar, exog = NULL, xvec = xvar, xadd, type, dnames).

We have already defined xvar, yvar and

Data.

Selecting exog Variable

exog = "political.afl" will define the data set based on

the factor levels of the "political.afl" in this case “0”

and “1”.

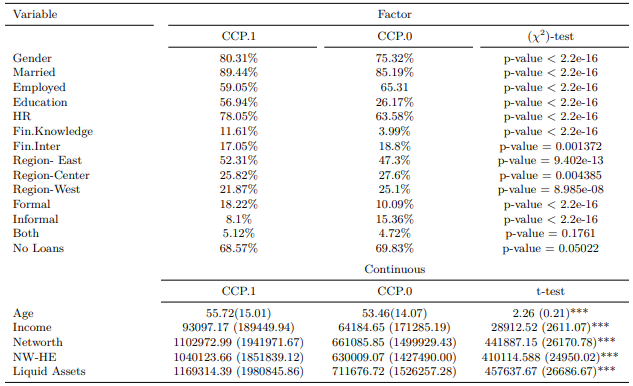

Note: HR stands for Household Registration. NW-HE is net-worth minus home equity. All the asset variables (e.g. income, net-worth, NW-HE, and liquid assets are in Chinese renminbi (CNY).

Selecting xadd Variable

xadd is a vector set which are not highly correlated

with "income" but highly correlated between them. So we

need to add each variable in

xadd = c("networth", "networth_homequity", "liquid.assets")

interchangeably.

Selecting type Variable

type can be on of the bagging (BAG),

boosting (GBM), random forest (RF),

multinominal logistic (MLM), and logistic models

(GLM).

Selecting dnames Variable

dnames is the factor values of exog. For

example dnames = c("0","1") since there are 2 levels in

exog = "political.afl" which is “0” and “1”.

dnames argument is important to avoid confusion when we

print out the results.

Implemantation

We can implement Estimate_Models for

yvar <- c("multi.level") as follows,

Results of the Estimate_Models

Using CCP.RF, we can see the outcomes of

BchMk+networth, BchMk+networth_homequity,

BchMk+liquid.assets D.0+networth,

D.0+networth_homequity, D.0+liquid.assets,

D.1+networth, D.1+networth_homequity, and

D.1+liquid.assets.

Estimate_Models implemented RF_Model,

firstly to all data set as it is called BchMk, secondly

D.0 and lastly D.1, adding 3 asset variables

interchangeably.

Where D.0 and D.1 are coming from the

dnames = c("0","1") and can be interpreted as

D.0 when political.afl == 0 and

D.1 when political.afl == 1

Estimate_Models reported BchMk with all the

exog variables and divided all the data set

(BchMk) in to 2-level, when the observation has

political.afl == 0 or political.afl == 1,

Since this is a list object we need to use attributes as

follows,

> CCP.RF$EstMdl$`D.1+liquid.assets`$results

mtry Accuracy Kappa AccuracySD KappaSD

1 2 0.7926901 0.3348631 0.04543311 0.1835925

2 6 0.7929825 0.3707344 0.03656725 0.1258099

3 11 0.7979532 0.3894589 0.03274767 0.1245565> head(CCP.RF$EstMdl$`D.1+liquid.assets`$Pred_prob)

zero one

3 0.992 0.008

4 0.124 0.876

8 0.290 0.710

25 0.742 0.258

33 0.854 0.146

36 0.750 0.250Building a Combined Performance

Estimate_Models reported predictive results for both

political.afl == 0 and political.afl == 1.

What we need is to combine these split data set to calculate over all

the performance for the political affiliation data split.

In the pomodoro help

field we can see that Combined_Performance was defined

as Combined_Performance(Sub.Est.Mdls).

We have already defined all we need in Estimate_Models

let`s bring them together.

Implemantation

Results of the Combined_Performance

Using attributes(CCP.NoCCP.RF) we can see the outcomes

of Combined_Performance

head(CCP.NoCCP.RF$Pred_prob)

CCP.NoCCP.RF$Roc

Call:

multiclass.roc.default(response = Combine.Mdl$Actual, predictor = Pred_prob)

Data: multivariate predictor Pred_prob with 2 levels of Combine.Mdl$Actual: zero, one.

Multi-class area under the curve: 0.6929CCP.NoCCP.RF$ConfMat

CCP.NoCCP.RF$ACC

Have Fun!